How Unstoppable AI Fraud Detection and AI Innovations Are Revolutionizing Finance

Estimated reading time: 8 minutes

Key Takeaways

- AI fraud detection systems reduce fraud investigation times by 70%

- Machine learning models achieve 30% better risk prediction accuracy

- AI-driven credit scoring expands access for 20% more underserved borrowers

- Trading bots execute thousands of transactions per second

- Quantum computing could solve risk models in seconds instead of days

Table of Contents

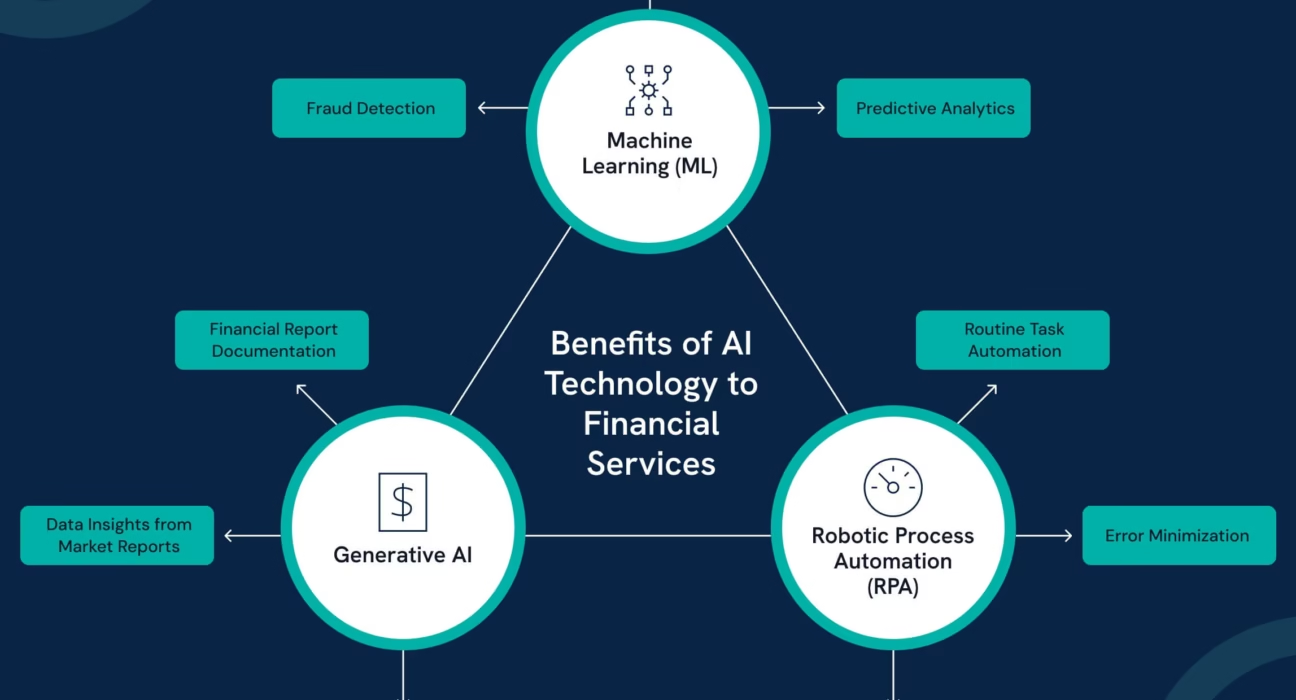

Artificial intelligence is rewriting the rules of finance, with unstoppable AI fraud detection emerging as the industry’s frontline defense through innovations like real-time transaction analysis. Let’s explore how these technologies are reshaping finance.

Section 1: Unstoppable AI Fraud Detection

Unstoppable AI fraud detection systems analyze millions of transactions in real time through:

- Adaptive learning: Machine learning models that evolve with new fraud patterns

- 60% fewer false positives: Through behavioral biometrics analysis (Netguru research)

Key implementations include biometric authentication systems and deepfake detection algorithms from Imperium’s research.

Section 2: AI in Risk Assessment

Modern systems leverage:

- Stress-testing simulations for market crashes

- Scenario modeling for regulatory changes (Snowflake implementations)

Banks report 30% improvement in prediction accuracy according to Accredian’s findings.

Section 3: AI-Driven Credit Scoring

Pioneered by companies like Upstart (IJSRA case study) and Tala’s smartphone scoring, these systems analyze:

- Alternative payment histories

- Social media patterns

- Device usage data

Section 4: AI-Powered Trading Bots

These systems feature:

- 24/7 cryptocurrency monitoring

- Sentiment analysis of news/social media

- Hybrid human-AI oversight models (Imperium safeguards)

Section 5: The Future of AI in Finance

Emerging trends include:

- Quantum-powered risk modeling

- GDPR-compliant data analysis via enhanced privacy protocols

- Explainable AI (XAI) for regulatory transparency

FAQ

How accurate are AI fraud detection systems?

Leading systems achieve 95%+ accuracy with under 0.1% false positives in production environments.

Can AI credit scoring work without financial history?

Yes – alternative data sources like rental payments and mobile usage patterns enable scoring of “credit invisible” applicants.

What safeguards exist for AI trading systems?

Circuit breakers, human oversight layers, and maximum exposure limits prevent catastrophic errors.